The area of hops cultivation in Poland, the Czech Republic and Germany is estimated at around 26,000 hectares, on which there are around 4 million poles impregnated with creosote oil banned by the EU. These plantations will have to replace structures in the coming years. The replacement is a long-term process, but it should be noted that each new hop and each repair of damaged structures must comply with EU restrictions. Due to the specificity of the construction, growing conditions and weather phenomena on plantations, the only prospective substitute for wood is composite. At present, on a global scale, only Polish Eko Chmiel can offer the technology of building a hop plant with the use of composite.

The beer market in Poland in 2018 amounted to approximately PLN 16 billion and accounts for half of all alcohol sales. Importantly, the structure of the market is changing, as evidenced by a 40% increase in sales of premium beer with a simultaneous decline in economy and mainstream beer. The non-alcoholic beers segment recorded an even higher growth, which after last year's 80% growth, together with special beers, already accounts for 5% of the market (i.e. has a value of PLN 1 billion).

Craft and craft breweries are developing the fastest, contributing significantly to the presentation of 853 beer premieres to the market in 2018. Currently, there are 600 craft breweries and 250 contract breweries operating in Poland. When analyzing the number of breweries per 1000 inhabitants in relation to such countries as the Czech Republic, Germany or the USA, it can be concluded that Poland has room for another several hundred breweries. The ongoing changes in the availability of brewing technology for the needs of e.g. restaurants allow us to expect a significant increase in the demand for high-quality hops for craft beer.

One cannot forget about individual brewers, of which there are about 30,000 in Poland (it is believed that it can increase to 100,000 people) - this is a group that is willing to buy the highest quality raw materials at relatively high prices. Craft brewing professionals are primarily driven by the taste and quality of beer - not the cost of its production. One thing seems certain today - the beer market was entering a new phase of development, where craft beer will be a driving force for the development of the entire industry with an increasing influence on the decisions of consumers and concerns themselves.

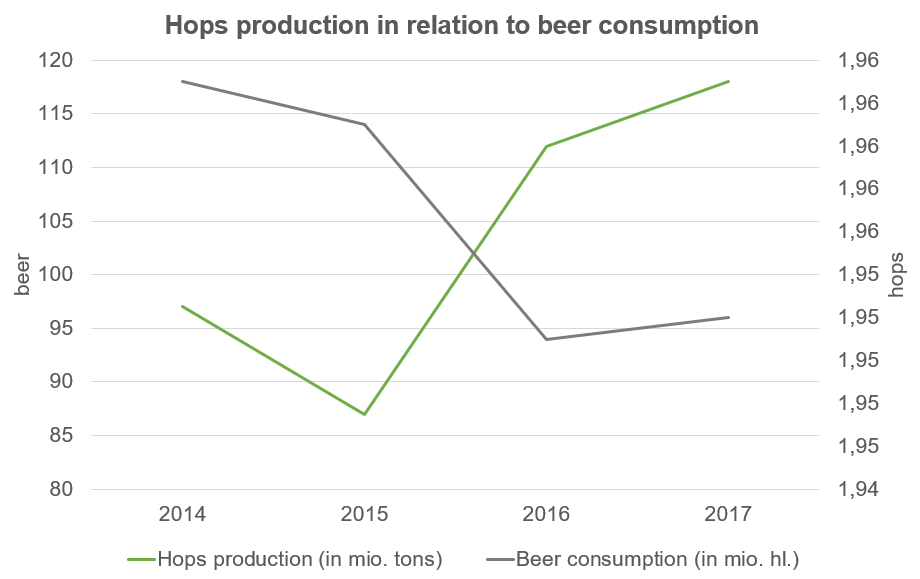

According to last year's report by the Barth-Haas concern, the production and demand for hops is growing rapidly, while the consumption of guild beer has a slight downward trend.

The share of hops in the production cost of a beer bottle is growing and from the level equal to the price of a cap in budget beers (i.e. a few groszy) it increases to PLN 1 in well-hopped craft beers, which means that the demand for high-quality beer hops will grow.

Summarizing:

- there is no good offer for growers to replace the forbidden pole impregnated with creosote oil;

- the beer market develops in principle only with craft and non-alcoholic beers;

- In contrast to mainstream and economy beer - high-quality beers record spectacular sales increases;

- the share of the cost of hops in one bottle of high-quality beer (and therefore more expensive) is small, and good hops are in demand on the market, so plantations offering such raw material are insensitive to the pricing policy of concerns;

- in the world we observe a clear trend towards higher hopping of beer and cold hopping;

- Plantations supplying hops of very high quality and in the varieties sought by the rapidly growing craft beer market will be a highly sought-after supplier.

HAVE QUESTIONS?

Be sure to use our contact form